Contoh Soal UTBK SNBT 2023, Tes Masuk Perguruan Tinggi Negeri

Contoh soal UTBK SNBT Literasi Bahasa Inggris

Contoh soal UTBK SNBT Literasi Bahasa InggrisJawaban benar D karena sikap atau kemampuan memahami masalah secara bersama-sama menjadi salah satu faktor penentu keberhasilan menghadapi pandemi.

2. Literasi dalam Bahasa Inggris

Contoh soal nomor 1

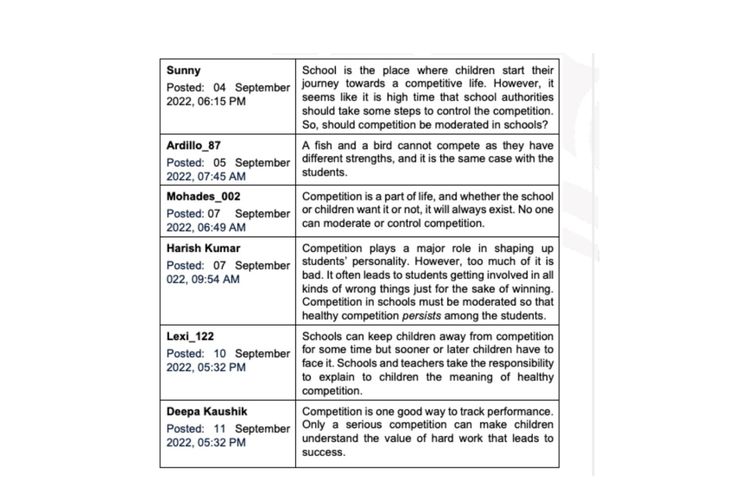

Who suggested moderating the school competition in order to create a healthy one?

a. Mohades_002

b. Lexi_122

c. Ardillo_87

d. Deepa Kaushik

e. Harish Kumar

Pembahasan

Jawaban benar E. Sebab, Mohades_002 menyebut tidak ada satupun yang bisa mengkontrol. That no one can moderate or control competition. B, C and D do not say anything about moderating the school competition.

Baca juga: SNPMB 2023, Biaya Kuliah Jalur Mandiri Sama dengan SNBT dan SNBP

Contoh soal nomor 2

You’ve been working and saving for decades for just this moment: retirement. Even though you may be ready to stop working full-time, now comes the hard part: letting yourself use your savings, since you no longer will be bringing in that paycheck, which until now has covered your monthly expenses. Making the psychological shift from saver to spender is no small effort for most people.

“Now you have this lump sum and have to draw it down. For some it’s almost physically painful,” said David John, a senior strategic policy advisor. Unpredictable factors like market performance, life expectancy and health issues make spending your money easier said than done. That’s why people may be hesitant to tap their savings because they think, “I have X dollars and it has to last me my whole life, but I have a very uncertain future. So, if I touch that I’m putting myself at risk.”

Research shows that among retirees with savings, many do not draw down very much, choosing instead to live off fixed sources of funds, such as Social Security or pensions or income from part-time work they take up. A study found that the vast majority of retirees in America still have at least 80% of their savings after two decades in retirement. No doubt this is partly because they are among the last generation of workers to benefit from corporate pensions.